Reimagining treasury management with stablecoins

Why global companies are turning to stablecoins for cross-border liquidity, and how Privy wallets enable programmable and automated treasury flows

Debbie Soon

|Sep 15, 2025

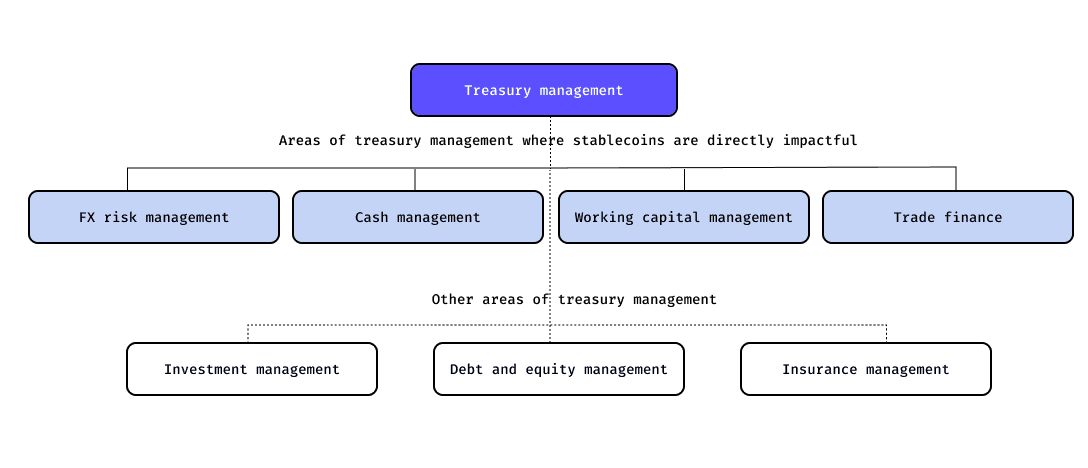

Treasury management is how a business oversees its cash, investments, and financial flows to ensure stability and efficiency. It spans everything from liquidity and funding, to risk management and compliance.

You see it in action every day: Robinhood moving funds from consumers to settle trades, DoorDash splitting payments between restaurants, dashers, and its own revenue, or Coca-Cola collecting sales around the world and paying a global workforce in dollars. For global enterprises, making sure money is always in the right place at the right time is what keeps operations running smoothly.

At a high level, treasury management involves:

Funding subsidiaries and local entities so each market has the capital it needs to operate.

Rebalancing ledgers across regions to maintain accurate books and optimize liquidity.

Managing idle cash so working capital is deployed efficiently rather than sitting unproductive.

Paying vendors, employees, and partners reliably, regardless of location or time zone.

When done well, treasury management minimizes financial risk while simultaneously maximizing return on available capital. It also creates room for growth: when too much capital is locked up in core operations, companies are forced to raise additional funds instead of scaling efficiently with what they already have.

In practice however, these seemingly straightforward tasks are limited by the capabilities of traditional banking infrastructure. For example, cross-border wires can take days to settle, and are further stalled by weekends and banking holidays. Capital sitting idle in the wrong account is another form of inefficiency — one that compounds as companies scale globally.

Why stablecoins for treasury management

For treasury management teams, the core challenge is balancing speed, cost, and control. Traditional rails often fall short: cross-border transfers can take days to clear, while fees accumulate through correspondent banks. The result is trapped liquidity and higher operational risk.

Stablecoins offer an alternative. Unlike bank transfers, they move on open networks that settle 24/7 in near real-time. For enterprises, this introduces a new set of capabilities:

Always-on settlement: Move funds instantly across time zones, without worrying about bank cut-off times or holidays.

Reduce FX risk: Settle transactions in dollar-denominated value, reducing exposure to exchange-rate volatility and minimizing the need for costly hedging strategies.

Cross-border efficiency: Transfer value globally without relying on correspondent banks or lengthy settlement chains.

Reduced idle capital: Rebalance accounts quickly to minimize float and put cash to work sooner. Traditionally, companies pre-fund accounts in multiple currencies to enable local transfers. With stablecoins, funds can move instantly when needed, freeing capital across markets.

Yield on working capital: Hold treasury balances in interest-bearing instruments so even short-term liquidity contributes to returns.

Programmable flows: Embed rules, triggers, and automation directly into payment logic.

Taken together, these capabilities make stablecoins practical for day-to-day treasury operations. For companies, this means less capital tied up in transit, more predictable liquidity across entities, and greater flexibility in how funds are deployed.

Treasury management in practice

Treasury management isn’t limited to banks or multinational corporations. It’s at the heart of how everyday businesses operate:

Robinhood needs to take funds from consumers and settle trades quickly, ensuring buy and sell orders execute without delay.

DoorDash accepts payments from consumers and instantly splits those funds across dashers, restaurants, and its own revenue share.

Coca-Cola collects revenue around the world and must manage liquidity centrally while paying a global workforce, often in dollars.

Now consider a global company with entities in New York, Buenos Aires, and Singapore. At the end of the quarter, the parent entity needs to rebalance cash across regions. Today, this typically involves international wires routed through multiple correspondent banks, each adding their own cut in fees and compliance checks. Settlement often takes two to three business days or longer if the transfer happens over a weekend.

During this time, funds are effectively frozen, as they are neither accessible in the origin account nor available in the destination. Worse, visibility into the payment’s status is limited. A small error can cause a transfer to get stuck in the system for days or even weeks, with little transparency into where the funds are or when they will settle.

For large enterprises, this idle capital represents significant opportunity cost: money that could otherwise be deployed for investments, vendor payments, or working capital needs sits in limbo, generating no return.

Stablecoin transfers eliminate this downtime. Instead of waiting days, funds can move across entities in minutes, reducing float and making capital available where it’s needed most.

Other treasury activities also benefit from this shift, such as paying vendors and contractors across borders without waiting on bank approvals or clearing times.

Programmable treasury management with Privy infrastructure

For enterprises to realize the benefits of stablecoin-based treasury, they need infrastructure that can reliably send and receive funds at scale. That’s where wallets come in. A wallet is the vehicle that moves money on stablecoin rails. It holds, sends, receives assets across entities, business units, and counterparties.

With Privy, wallets go one step further, and become programmable treasury systems that allow for:

Multi-entity design: Set up wallets for subsidiaries, regions, or business units. For global companies with multiple entities, stablecoin transfers can be used to rebalance ledgers automatically and at scale.

Event-driven automation: Use webhooks to be notified the moment funds land, then instantly sweep them to a destination wallet.

Programmable signers: Automate recurring treasury activity, such as intercompany transfers, subscription payments, or batch disbursements; using session signers configured with business logic.

Flexible custody: Treasury needs vary. Privy can spin up custodial omnibus wallets for centralized treasury management and/or self-custodial wallets for users – applied dynamically at a regional or user level to match your requirements.

Enterprise controls: Apply security policies, approval logic, and compliance workflows to mirror existing treasury standards.

The result is a treasury infrastructure that doesn’t just move capital faster, but does so with automation, visibility, flexibility, and resilience built in.

We’re already powering treasury flows for fintech companies like Kulipa, with many others exploring similar architectures. It’s early days, but the trajectory is clear: stablecoin-based treasury management is moving from concept to practice.

Privy provides the enterprise-grade wallet infrastructure to make those flows programmable, automated, and secure – helping companies build treasury systems of the future.