Building Privy Pay

A tap to pay experience with Farcaster mini apps

Payton Garland

|May 8, 2025

In today's world, tap to pay isn't just convenient, it's transformative. Every coffee shop, retail store, and subway station offers this seamless experience that feels like magic: unlock your phone, hover over a small screen, and you're done. In seconds, your transaction completes with minimal effort. This isn't just the status quo, it's the standard that defines modern commerce.

In order to rearchitect the financial system on crypto rails, we need to make crypto usable. For mainstream adoption to become reality, in-person crypto transactions must be as intuitive and reliable as the payment experiences people already love. This is why we built Privy Pay.

Today’s post walks through the details of how we stood this up, so you can build your own onchain tap to pay experience.

Why now

FarCon struck us as an incredibly unique opportunity to reimagine crypto payments:

There was critical mass of users with Warpcast installed on their mobile device

These users likely had funds loaded into their Warpcast wallet (Warplet, a Privy wallet)

Warpcast recently released support for direct mini app linking with context

The vast majority of phones created in the past 5 years support NFC

This provided the perfect foundation to build a crypto tap to pay experience that mirrors the effortless Apple Pay / Google Pay flow we all know today. Before we explore how we built this experience, it’s important to understand the evolution that brought tap to pay to its current form.

A history on contactless payments

This seamless UX did not come easy. In fact, the first tap to pay experience was deployed about 30 years ago in 1996 and was called UPass, Seoul’s prepaid bus transit card. The Seoul Bus Transport Association created an RFID-based payment solution that allowed passengers to tap their prepaid card to pay for bus fares.

It wasn’t until 2001 that we saw our first NFC-based payment solution with the FeliCa card from Sony which was used to power Edy (Euro, Dollar, and Yen). This technology pre-dates official NFC. The difference between NFC and RFID is that NFC operates over a much shorter range and enables secure, back-and-forth communication.

In 2011 and 2014, we saw the eventual release of what is now known as Google Pay and Apple Pay.

Over the years, tap to pay has been standardized through a massive amount of coordination between phone manufacturers, payment processors, and merchants. The likes of Blackbird, Square, and Toast have paved the way for creating beautiful consumer payment experiences.

Building Privy Pay

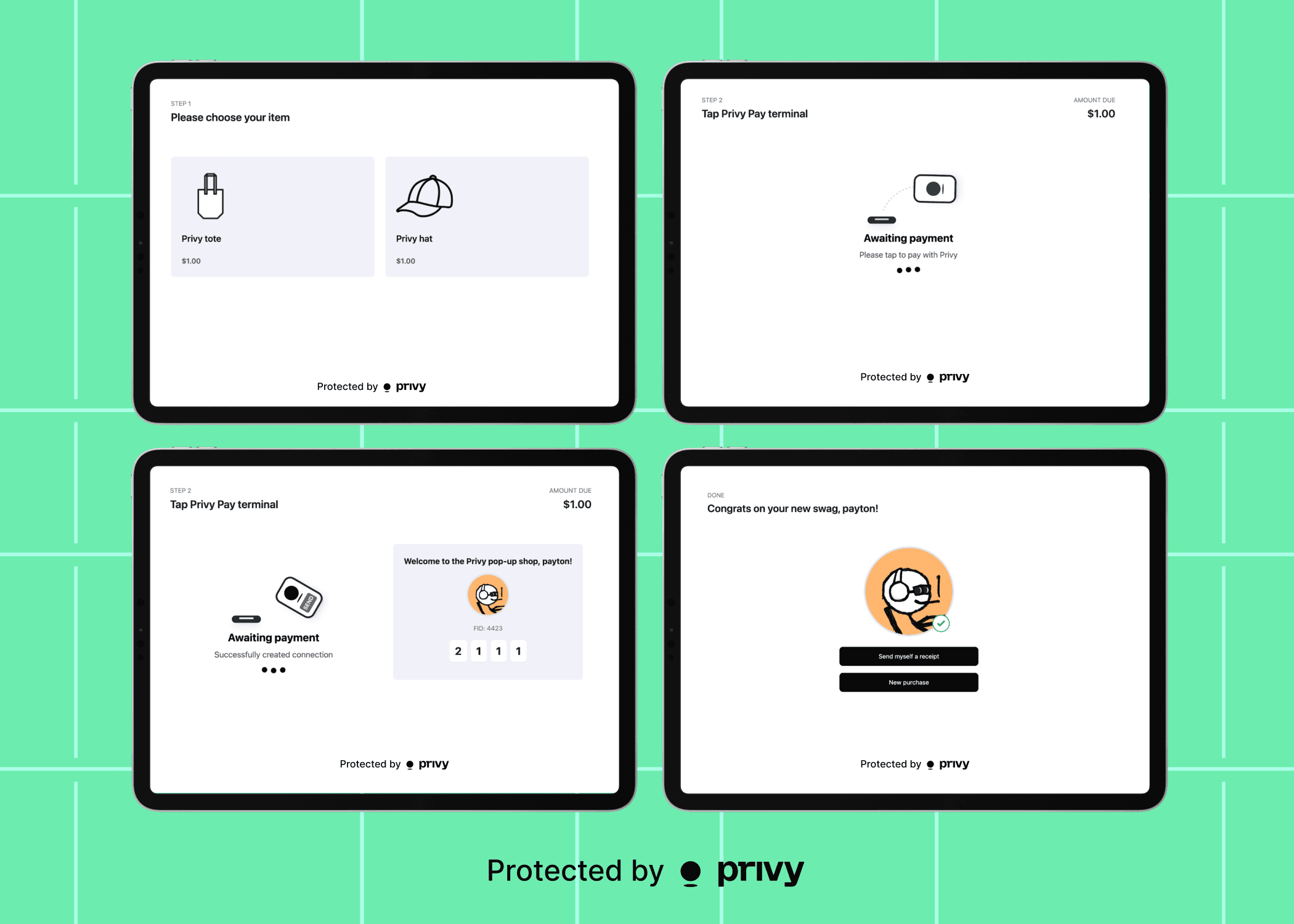

The goal of Privy Pay was straightforward: create a delightful consumer crypto checkout experience that minimizes transaction time. We constructed this experience through two key components:

1) Terminal

The best checkout experiences share universal elements: a visible touchscreen and a clearly marked tap location. We set out to recreate this experience with the following materials:

Custom 3D-printed enclosure

We developed a streamlined self-checkout experience on the Raspberry Pi built as a React app with Electron. This interface guided consumers through a simple two-step process: select item and tap phone. Our 3D-printed Privy Pay brick, containing a programmable NFC tag, provided the physical tap target that users immediately recognized.

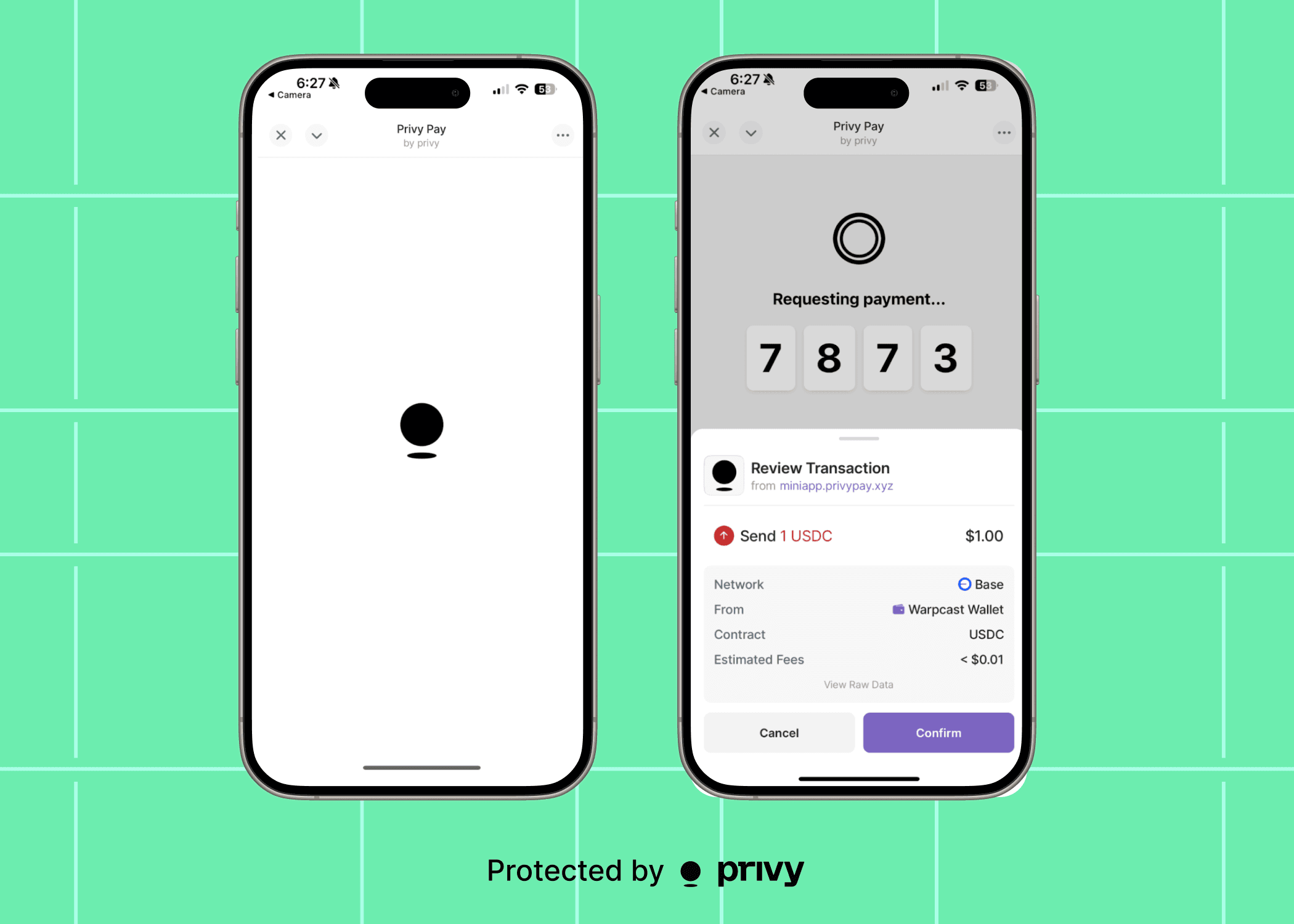

2) Farcaster mini app

Next, we began building out the Privy Pay mini app. Utilizing mini app URLs, our customers can seamlessly be deep linked into the Privy Pay mini app with all transaction context loaded. This means they will

Tap their phone to the Privy Pay NFC brick

Open a deep link to the Privy Pay mini app

Be immediately prompted to complete the transaction

The mini app itself was built quickly and reliably with Val Town. Its primary function is to facilitate a transaction between the user and a terminal. After signing the transaction, the Privy Pay mini app will notify the terminal of a completed purchase, which will then be displayed to the user.

Throughout the mini app interaction, the user is constantly given immediate feedback on the terminal. This is especially important for an in-person user flow because it bridges the digital-physical divide, eliminating uncertainty and creating the same confident, responsive experience that made Square and Toast revolutionary in retail environments.

A significant advantage of mini apps is easy access to authenticated data about the user, enabling personalized experiences. The terminal displays each customer's Farcaster profile and name, transforming routine transactions into memorable interactions for FarCon attendees.

The final product

We set up the Privy Pay demo at our Archetype <> Clanker <> Privy happy hour for FarCon 2025 to sell Privy hats and totes. The response was electric, attendees experienced firsthand the power of seamless crypto transactions. You can check out a recording of our live demo over on Farcaster.

What’s next

While Privy Pay was created as a novel experience for FarCon, we won’t be stopping there. The UX of in-person crypto transactions clearly needs some work for mainstream adoption. We plan to push forward on the standardization of in-person transactions. Merchants should be empowered to utilize the full benefits of crypto: immutability, self-custody, and programmable money, without sacrificing the intuitive, responsive user experience that consumers have come to expect from modern payment systems.

If you’re excited to work with us on standardizing onchain tap to pay experiences, please reach out at hi@privy.io. We can’t wait to build with you.